Niche Expertise

Taylor bonds cutting edge technology and a niche financial knowledge base to catalyze value-add change -- from small businesses to Fortune 100 enterprises. Taylor's passion is improving the management of private and institutional capital. As the world of technology and business moves at a faster pace, having someone on your team that knows the intricacies of both technology and capital management is an indispensable asset for the firm of the future. Teams need to work smarter by utilizing technology to build data-based heuristics for more effective decision making.

Finance

From working on one of the first Regulation A+ IPOs with W. R. Hambrecht, investment bankers for Apple and Google IPOs, to building out the entire technology stack for a commercial real estate company and his candidacy in the CFA program, Taylor brings a wealth of experience and technical knowledge for financial clients.

Software Development

Taylor's experience in front-end development to a full-stack focus at a Fortune 100 bank positions him well to understand the nuances of new projects in a sleu of industries. Taylor believes a long-term vision and a ruthless focus on value should be paramount.

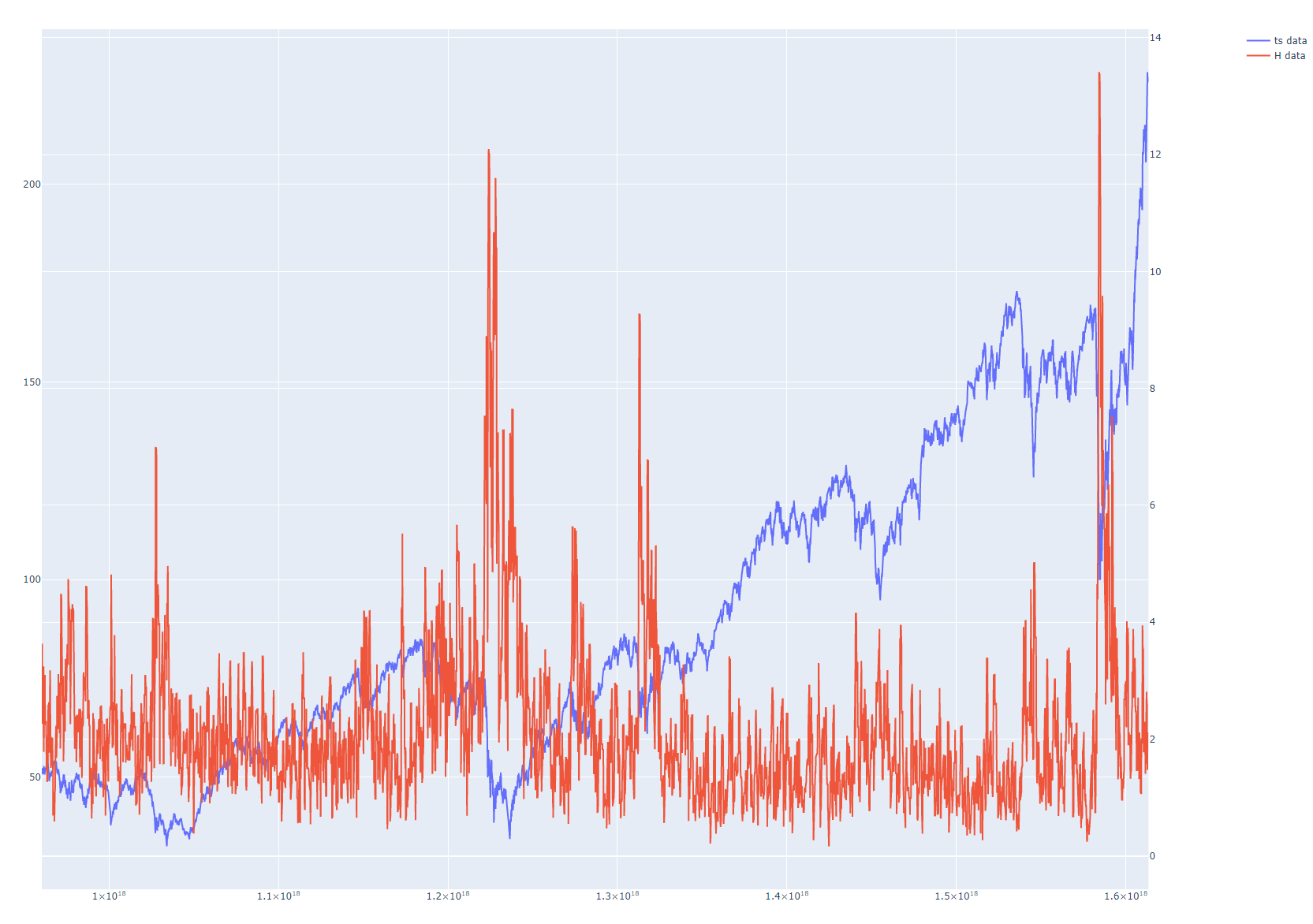

Machine Learning

From his time at a quantitative hedge fund and a private real estate fund to his many years at one of the top banking institutions in North America, Taylor's experience in applying machine Learning technology to real-world business problems is as much deep as it is wide.